Financial Aid

Free Application for Federal Student Aid (FAFSA) APPLICATION Opens DECEMBER 1st 2024.

- Streamlined 2025-26 FAFSA Application opening DEC '23 TBA and deadline APRIL 2nd

- Student Aid Index (SAI) replaces EFC.

- Changes in need analysis for family/small business owners, siblings in college.

- Expanded access to Pell Grants.

- 'Contributors' - "New terminology" to describe parents or spouse of FAFSA filer.

- FSA ID: ALL Contributors will need to have an FSA ID, including undocumented parents.

- For divorced/separated parents, change to who may be expected to file FAFSA and the parent providing the most financial support must be included on the new FAFSA.

Visit https://www.csac.ca.gov/ for more information. In order to qualify for a Cal Grant, students must file a FAFSA or California Dream Act Application. The FAFSA is FREE for seniors to apply, the earlier you apply the greater chance for aid, do not wait to apply.

Statewide Financial Aid Workshops (coming soon)

The California Student Aid Commission has upcoming workshops covering the Cal Grant program, the California Dream Act Application and the California Dream Act Service Incentive Grant.

What’s an FSA ID?

The FSA ID is a username and password combination you use to log in to U.S. Department of Education (ED) online systems. The FSA ID is your legal signature and shouldn’t be created or used by anyone other than you. EVERYONE must create a FSA ID whether you have a social security number or not. You’ll use your FSA ID every year you fill out a Free Application for Federal Student Aid (FAFSA®) form and for the lifetime of your federal student loans.

UNDERSTANDING CAL GRANT A, B, & C read here

How can I apply for the Cal Grant?

To be considered for a Cal Grant you must file the FAFSA by April 2, 2024. The California Student Aid Commission advises students to file as early as possible. In addition, a Cal Grant GPA must be submitted for each student that wishes to receive a Cal Grant. LAUSD will submit all Seniors' Cal Grant GPA to the California Student Aid Commission. After you submit your FAFSA, check the status of your Cal Grant here.

What tax forms will I use for the FAFSA?

2023 or 2024 tax forms (HINT: If you or your parents file a tax return with the IRS, you may be eligible to use the IRS Data Retrieval Tool. This is an easy way to provide accurate tax information, view and securely transfer information into FAFSA)

Undocumented students Can NOT apply for financial aid using the FAFSA. You must complete the CA DREAM Act application.

CA Dream Act (CADAA) FAQ's for students and parents, please click here.

CSS /Financial Aid Profile: Seniors applying to private universities that require the CSS profile need to complete the online CSS Profile no later than November 1 for Early Decision and Early Action applications and no later than December 1 for Regular Decision applications. Check specific colleges for extended deadlines. The profile allows students to report their financial and family circumstance information in one streamlined application and submit it to all the colleges that require it for scholarship and grant consideration. Apply online. Fee is $25 for the profile and first college report and $16 for each subsequent college report. Fee waivers are available for eligible applicants.

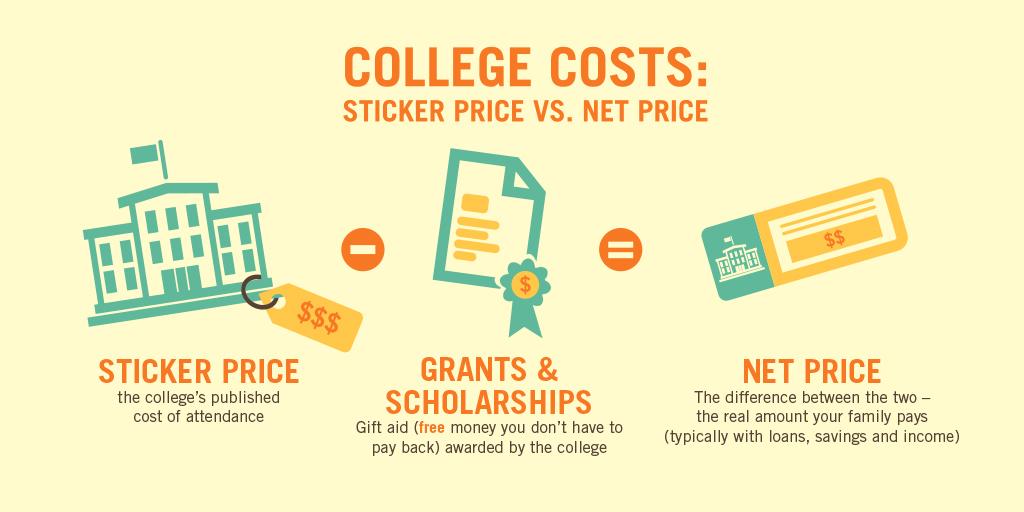

Can I better predict how much aid a college will give me before I receive a financial aid package from the university?

A college net price calculator is a free online tool that gives you a personalized estimate of net price. Check out net price calculators for hundreds of colleges.

.Yes! Each college has a Net Price Calculator on their website. Go directly to a college's website's financial aid page and find the Net Price Calculator. There you will be able to input information and get a better sense of what type of aid the college will offer and college affordability overall.

RESOURCES:

California Student Aid Commission - www.csac.ca.gov

Federal Student Aid - www.studentaid.ed.gov

Free Application for Federal Student Aid - www.fafsa.ed.gov

CSS PROFILE - https://student.collegeboard.org/css-financial-aid-profile Ed Fund - www.edfund.org

FastWeb for scholarships - www.fastweb.com

College Scorecard - https://collegescorecard.ed.gov/

Scholarships students to acquire throughout High School: https://www.raise.me/

Scholarships for Undocumented Students:

MALDEF Scholarship Resource Guide

- Western Undergraduate Exchange WUE https://www.wiche.edu/tuition-savings/wue/

- Colleges who meet 100% Financial Need

- POSSE FOUNDATION Scholarship https://www.possefoundation.org/ - 11th Grade (rising Seniors)

scholarship program that is NOT need-based. The Posse Foundation identifies, recruits and trains individuals with extraordinary leadership potential. Posse Scholars receive full-tuition leadership scholarship at one of their partner colleges and universities.

scholarship program that is NOT need-based. The Posse Foundation identifies, recruits and trains individuals with extraordinary leadership potential. Posse Scholars receive full-tuition leadership scholarship at one of their partner colleges and universities. - QUESTBRIDGE - 11th/12th Grade https://www.questbridge.org/ -

QuestBridge is a non-profit organization that helps high-achieving, low-income students gain admission and scholarships to over 45 of the country's top ranked-colleges. QuestBridge does this by partnering with these schools to identify and support students who otherwise may not apply to leading colleges. They seek high achieving (typically top 5-10% in their class), first generation, and those who come from households that typically earns less than $65,000 annually for a household of four. Students who come from a household earning more than this amount but feel that they have faced economic hardship and fit the QuestBridge criteria with being high-achieving, low-income, are also encouraged to apply.

QuestBridge is a non-profit organization that helps high-achieving, low-income students gain admission and scholarships to over 45 of the country's top ranked-colleges. QuestBridge does this by partnering with these schools to identify and support students who otherwise may not apply to leading colleges. They seek high achieving (typically top 5-10% in their class), first generation, and those who come from households that typically earns less than $65,000 annually for a household of four. Students who come from a household earning more than this amount but feel that they have faced economic hardship and fit the QuestBridge criteria with being high-achieving, low-income, are also encouraged to apply.

2024-2025 FAFSA Updates

Middle Class Scholarship

Simple steps to transfer tax transfer-tax-info-to-fafsa